montana sales tax rate 2020

ARM 4214101 through ARM 4214112 and a 4 Lodging Sales Tax see 15- 68-101 MCA through 15-68-820 MCA for a combined 8 Lodging Facility Sales and Use Tax. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000.

States Without Sales Tax Article

Jordan MT Sales Tax Rate.

. State Business Tax Climate Index. This reduction begins with the 2022 tax year. Sales Tax Breakdown Bigfork Details Bigfork MT is in Flathead County.

The December 2020 total local sales tax rate was also 0000. And Friday 900 am. Montanas sales tax rates for commonly exempted categories are listed below.

Sales Tax Breakdown Laurel Details Laurel MT is in Yellowstone County. The Billings sales tax rate is. Sales Tax Breakdown Gardiner Details Gardiner MT is in Park County.

Were available Monday through Thursday 900 am. Montana currently has seven marginal tax rates. Both these taxes are collected by the facility from the user and remitted to the Department of Revenue.

Some rates might be different in Montana State. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Montana State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Montana.

Did South Dakota v. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. The recent Montana tax reform package made several changes to individual and corporate taxes.

Vehicle owners to register their cars in Montana. Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800.

The minimum combined 2022 sales tax rate for Billings Montana is. Vehicle fees were nearly 8 of total general fund revenue while in 2020 that number declined to about 4. The December 2020 total local sales tax ratewas also 0000.

State and Local Sales Tax Rates. Laurel MT Sales Tax Rate Laurel MT Sales Tax Rate The current total local sales tax rate in Laurel MT is 0000. Senate Bill 159 passed during the 67th Montana Legislative Session reduced the highest marginal tax rate for individuals estates trusts and pass-through entities.

2020 Montana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Sales Tax Breakdown Libby Details Libby MT is in Lincoln County. Exact tax amount may vary for different items.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Bigfork MT Sales Tax Rate The current total local sales tax rate in Bigfork MT is 0000. The December 2020 total local sales tax rate was also 0000.

The December 2020 total local sales tax rate was also 0000. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. This is the total of state county and city sales tax rates.

Montana has no state sales tax and allows local governments to collect a. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help. Gardiner is in the following zip codes.

The states general fund revenues grew modestly in FY 2020 despite the pandemic and is running substantially higher in FY 2021 with forecasts showing. Whitefish Sales Tax Calculator. The current total local sales tax rate in Libby MT is 0000.

Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets. T HE L UXURY V EHICLE M OTORHOME F EE AND TAX INCENTIVES. The current total local sales tax rate in Jordan MT is 0000.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. Avalara provides supported pre-built integration. The County sales tax rate is.

2022 Montana state sales tax. Minnesota Sales Tax Calculator. Montana State Sales Tax Calculator.

Bigfork is in the following zip codes. Montanas income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2004Montanas tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax.

Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering. Some rates might be different in Whitefish. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Tax rates and. The Montana sales tax rate is currently. There are additional taxes.

Wayfair Inc affect Montana. The December 2020 total local sales tax rate was also 0000. Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected.

These two taxes are a 4 Lodging Facility Use Tax see 15-65-101 MCA through 15-65-131 MCA. Libby is in the following zip codes. Montanas sales tax rates for commonly exempted categories are listed below.

The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data. 160k Salary Example. The current total local sales tax rate in Gardiner MT is 0000.

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Income Tax Information What You Need To Know On Mt Taxes

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana Income Tax Mt State Tax Calculator Community Tax

Montana State Tax Returns For 2021 2022 On Efile Com

Sales Taxes In The United States Wikiwand

Montana Tax Information Bozeman Real Estate Report

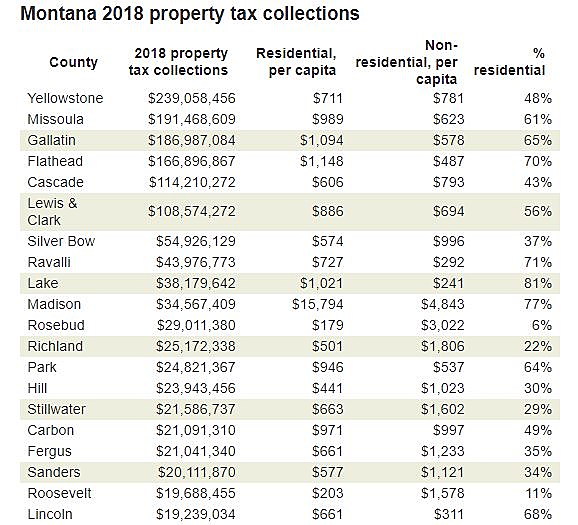

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Sales Taxes In The United States Wikiwand

How To Charge Sales Tax And Shipping For Your Online Store Hostgator

Montana Tax Information Bozeman Real Estate Report

Software Sales Tax Use Tax Avalara

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

Montana State Taxes Tax Types In Montana Income Property Corporate

U S States With No Sales Tax Taxjar

Montana Property Taxes Montana Property Tax Example Calculations

Montana State Taxes Tax Types In Montana Income Property Corporate